child tax credit october 15 2021

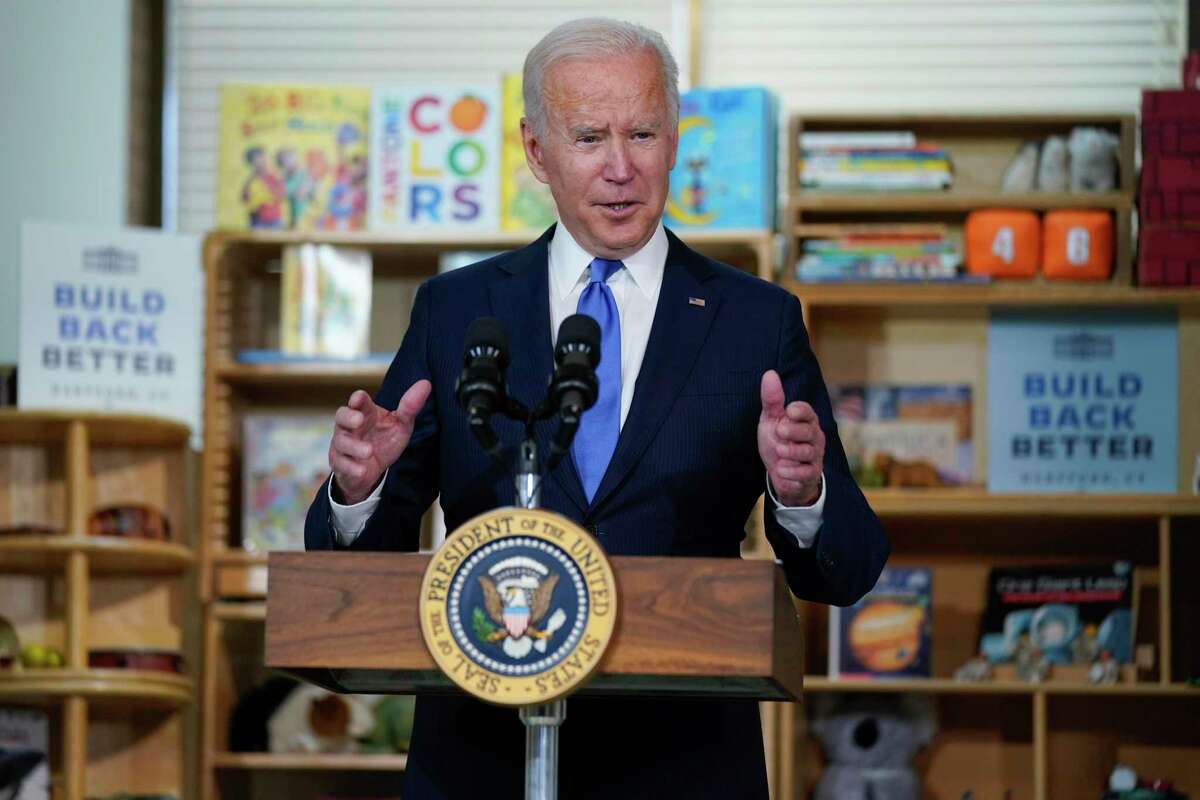

Millions of families should soon receive their fourth enhanced child tax credit payment which the Internal Revenue Service distributed on Friday. Ad File Your Taxes Online for Free.

2021childtaxcredit Explore Facebook

Future payments are scheduled for November 15 and December 15.

. Parents of a child who ages out of an age bracket are paid the lesser amount. When will I receive the monthly Child Tax Credit payment. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Makes the credit fully refundable. The law requires nearly half of the credit to be sent in advance which is. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Alamy The child tax credit scheme was expanded to 3600 from 2000 earlier this. Find out if you qualify for the Child Tax Credit in 2021 and how to claim it on your taxes. Parents of a child who ages out of an age bracket are paid the lesser amount.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The schedule of payments moving forward will be as follows. If you select direct deposit your money will be paid out on that date.

That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for. The 4th payment of the expanded federal Child Tax Credit goes out on October 15 AP PhotoBradley C. Families with qualifying children will receive 3000 for each child age 6 to 17 and 3600 for each child under 6.

Thats an increase from the regular child tax. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Child tax credit 2021 update Payments worth 15billion to be sent out to American families THIS week.

Taxpayers who missed the April 15 deadline have until October 17. Fri October 15 2021. October 15 Deadline Approaches for Advance Child Tax Credit.

Learn More at AARP. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the. Even if you dont owe taxes you could get the full.

As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of. Child tax credit payments worth up to 300 will be deposited from October 15 Credit. The new advance Child Tax Credit is based on your previously filed tax return.

For these families each payment is up to 300 per month for each child under age 6 and up to 250 per. The cash will come in the form child. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Todays WatchBlog post looks at our work on COVID-19 payments to individuals including the Child. Bower File BALTIMORE WBFF Stimulus payments will continue to.

Ad File a free federal return now to claim your child tax credit. To be a qualifying child for the 2021 tax year your dependent generally must. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

November 15 2021 Deadline For Non Tax Filing Families To Use Child Tax Credit Portal Lone Star Legal Aid

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Recovery Package Should Permanently Include Families With Low Incomes In Full Child Tax Credit Center On Budget And Policy Priorities

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

Child Tax Credit 2021 Update Families Won T Receive Any 300 Relief Payments Unless They Act By This October Deadline The Us Sun

What To Know About The First Advance Child Tax Credit Payment

Irs Announces A Backlog Of Child Tax Credit Payments

Gregoryschoice Peach Mcintyre Monthly Child Tax Credit Payments Started Being Issued Today July 14 2021 These Monthly Payments Will Continue To Be Issued Every Single Month Until December 15 2021 1st

Stimulus Update Here S When To Expect October Child Tax Credit Payment Silive Com

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Oct 15 Is Tax Deadline For Extended 2020 Tax Returns

4th Child Tax Credit Payment Update 10 15 21 Youtube

Child Tax Credit When Will Your October Payment Show Up Cbs Sacramento

Child Tax Credit Payments Could End Soon Here S What You Need To Know

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner